Investment Planning

One of the huge challenges facing financial advisors is selecting the most appropriate unit trust funds to construct investment portfolios that will deliver expected and required results. We have developed a sound process of constructing portfolios in partnership with Finametrica and Fundhouse

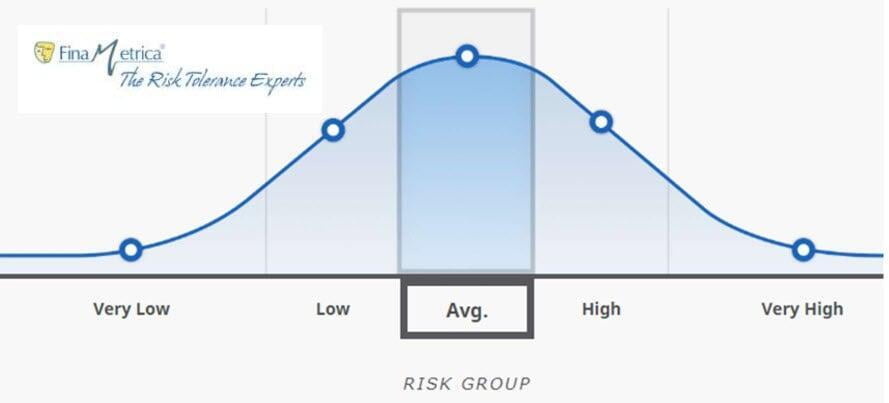

Risk Profiling

The Finametrica risk profiling system was developed and is maintained by the School of Psychology at the University of New South Wales in Australia.

The tool groups people into one of 5 main risk groups who have similar expectations about how their investments should behave in terms of risk and performance.

Portfolio Construction

More defensive assets (bonds & cash) in a portfolio will create a more conservative portfolio.

More growth assets (equity & property) will create a more aggressive portfolio.

We have balanced Growth and Defensive assets to create 5 portfolios that match the expectations of the 5 Finametrica risk groupings - from Conservative to High Growth.

We have chosen the Allan Gray Investment Platform to host and administer our portfolios.

The portfolios are invested in unit trusts in your name so it is a very safe and secure arrangement.

Investment Strategies

Pre-retirement strategies - investing while you are still working and earning an income has it's challenges but it is fairly straight forward - if you start early enough and stay with the plan.

Post-retirement strategies - creating an investment strategy to provide a post-retirement income is far more dangerous. The retiree has to cope with a host of risks including: Investment Sequence Risk, Unknown Longevity, Market Volatility, Reduced Earning Capacity, Declining Cognitive Skills and Rising Health Costs.

Many of these risks cannot be controlled but it is possible to implement strategies to minimise these risks.

MHR Wealth Management Investment Portfolios

MHR Conservative Portfolio 10% to 20% growth assets - benchmark Money Market. Click for the latest information sheet

Appropriate for investors who are risk averse but want a better return than "money in the bank"

MHR Cautious Portfolio 30% to 45% growth assets - benchmark CPI +3%.

Appropriate for investors who are low risk but do want a small amount of capital growth

MHR Balanced Portfolio 50% to 65% growth assets - benchmark CPI +5%. Click for the latest information sheet

Appropriate for investors who are moderate risk and want long-term, low risk capital growth

MHR Growth Portfolio 65% to 80% growth assets - benchmark CPI +7%. Click for the latest information sheet

Appropriate for investors who are moderately aggressive and want long-term capital growth

MHR High Growth Portfolio 80% to 100% growth assets - benchmark JSE Top 40 Index. Click for the latest information sheet

Appropriate for investors who want aggressive long-term capital growth and can tolerate volatility

MHR Global Equity Portfolio in USD This is an "offshore" equity portfolio and is not domiciled in South Africa. Click for the latest information sheet